| TEXAS SNAPSHOT, NOVEMBER 2007

Dallas Office Market

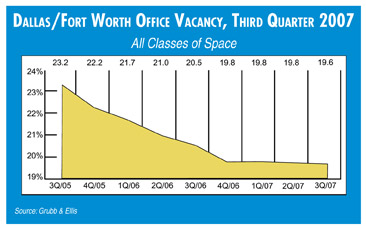

According to Grubb & Ellis’ Third Quarter 2007 Dallas/Fort Worth Office Market Trends, annual absorption across the Dallas/Fort Worth office leasing market accumulated to nearly 2 million square feet through the first 9 months of the year. Even though the local market has not witnessed the same energy as last year, where absorption was 2.7 million square feet higher at the close of September, dynamics were healthy considering the downturn in the credit and sub-prime industries.

Little speculative space coming on line helped balance an increase in sublease inventory in recent months, and, unlike the first 6 months of the year where primarily Class B space was absorbed, the third quarter resulted in more than a half million square feet of gains in the Class A sector, according to Grubb & Ellis’ third quarter report. “Accordingly, Class A vacancy fell to an even 17 percent at the close of September, down 20 basis points compared to September 2006,” says Stephanie Seno, research analyst for Grubb & Ellis. “Meanwhile, the Class B market absorbed about 270,000 square feet with vacancy settling at 22.5 percent, an improvement of 2 percentage points over the 12-month period ending September 2007.”

Asking rents across the Metroplex continued to swell in recent months with a third quarter average of $21.62 full-service gross per square foot per year, an increase of $0.57 compared to mid-year figures, Seno says. “Average asking rents for Class A product ended the month of September with a $24.87 average, spiking $2.01 since the same time in 2006,” she says. “The average asking rate for Class B space across the Metroplex also swelled in the last year by $1.30 to $18.19.”

The local office construction pipeline increased by another 800,000 square feet in the last three months, bringing the total square footage underway to an amazing 5.5 million, its highest level since late-2004, according to Grubb & Ellis’ third quarter report. “Harwood International broke ground on the most notable project: the $100 million Saint Ann Court, a speculative 280,000 square foot office building located in Uptown/Turtle Creek,” says Seno.

Taking into account the recent challenges in the credit and commercial backed securities markets, Dallas/Fort Worth investment volume cooled slightly in third quarter 2007, according to the Grubb & Ellis third quarter report. Total Metroplex office sales volume for the 12-month period ending August 2007 added up to $4.8 billion in trades, approximately $430 million lower than the previous survey period, according to Real Capital Analytics. “Average capitalization rates slipped 20 basis points over the same time period to end the month of August at 6.9 percent,” Seno adds.

Most notably, the 13-property Crescent Real Estate Equities Company disposition deal closed in August, and San Diego-based Equastone Inc. acquired the 3 million-square-foot portfolio for $382 million, Seno says. “Other major investment news came just before the close of the quarter when Fortis Property Group put its Galleria portfolio on the market, which includes the Galleria Towers and JP Morgan International III in North Dallas along with NEC Corporate Center in Irving,” she says. “The high-end portfolio, comprised of 2 million square feet, is anticipated to sell for upwards of $600 million.”

The news pertaining to overall Metroplex employment was mixed at the close of September. Despite sustained employment growth, the overall increase was lower than the average 3.0 to 3.5 percent, which the Metroplex has grown accustomed to in the last 24 months, Seno says. According to the Bureau of Labor and Statistics, the Dallas-Fort Worth-Arlington metropolitan statistical area (MSA) added approximately 78,800 new jobs to local payrolls in the 12-month period ending August 2007, equivalent to a growth rate of 2.7 percent. Expanding by 5.7 percent, the construction and mining sector added about 10,200 new jobs area-wide during the same time period. The leisure and hospitality sector created 13,800 new positions, equivalent to a 5.1 percent increase. Rounding out the top three contributors to local MSA employment growth, professional and business services grew by 19,000 jobs, or a 4.5 percent expansion. “Fortunately, in the third quarter, losses in the lending industry were offset by new jobs in the construction and hotel sectors,” Seno says. Unlike the past 18 months where growth among the office-using employment sectors was almost guaranteed, further anticipated job cuts in the lending and homebuilding industries may adversely affect the local office leasing market in the final months of 2007. The outcome will depend on whether or not continued growth in the financial and other services sectors can counterbalance these losses.”

During the third quarter, downtown Dallas landlords witnessed an increase in leasing demand for Class AA space, particularly on Ross Avenue, according to Seno. “Chase Tower and Trammell Crow Center, for example, profited from several expansion deals by firms such as Baker Botts LLP and PricewaterhouseCoopers,” she says. “With only one full floor of direct Class AA space available in the Dallas CBD, landlords were able to hike up asking rents.”

For instance, these premium Downtown buildings were commanding rental rates in the high-$20 to low-$30 range plus electric at the close of September 2007, according to Grubb & Ellis’ third quarter report. Meanwhile, the third quarter Dallas CBD Class A average stood at around $23.50 full-service gross per square foot per year, which equates to roughly $21.30 plus electric. “While the Class AA market was tight at the close of September, expect market dynamics to change as Hunt Consolidated vacates 300,000 square feet of space in Fountain Place in the fourth quarter when the firm takes occupancy of their newly-built headquarters on Akard Street,” Seno says. “Competition among landlords will heat up in the next 18 months, ultimately tipping the scale to the tenant’s advantage.”

In terms of the Metroplex sublease market, it is not surprising that an additional half million square feet of space was added to inventory in third quarter 2007 given the turmoil in the credit markets and sub-prime mortgage industry disintegration, Seno notes.

“Total sublease inventory reached 4.6 million square feet at the close of September, a 1.3 million-square-foot escalation since last year at the same time, which is certainly higher than the historical Dallas/Fort Worth average of around 3 million square feet,” she says. “The last time the Metroplex maintained a 5 million-square-foot plus inventory was in 2004. There are rumors around the industry of additional companies looking to reduce their office space in the closing months of the year. With a significant amount of sublease space coming on line — particularly when a long-term is left on the lease — local office users will be presented with opportunities in the final quarter of 2007.”

— Stephanie Seno is a research analyst for Grubb & Ellis.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints of

this article contact Barbara

Sherer at (630) 554-6054.

|